Consultant Charge-out Rates

If you have ever worked as a consultant or employed a consultant, you will have come across the huge difference between the hourly rate paid to the consultant and the consultant charge-out rates – the rate the consultant is charged out to customers.

Typically, the consultant may be getting paid $50 per hour, yet their charge-out rate is $200/hour.

Why the Discrepancy?

Salary alone is not the only cost your employer has to pay.

They also have to pay:

- Superannuation (401k) – in Australia, that’s 12% of salary.

- Office space for you

- Power, air conditioning, insurance

- Desk, computer, software licences, phone

- Training and development

- Partial costs of your supervisor (they may only be 50% billable)

- Recruitment costs

- Payroll system costs

What is Billable Time?

Billable time is time spent by the consultant working on tasks directly attributed to a client that can be billed to that client.

A typical consultant can be expected to have a billable rate of 80% or higher.

This means for a 40-hour week, 32 hours must be billable to clients, every week. This only leaves 8 hours for the week to deal with emails, internal meetings, attend training etc – all non-billable tasks.

This is just 96 mins per day, just over 1.5 hours for all these non-billable tasks. While it sounds like a lot, once you finish reading your morning emails and attend just one internal meeting – your non-billable time is exhausted for the day.

Some consultants are expected to have a higher rate. At 90% you have only 48 mins per day of non-billable time.

Let’s do the Math

- Hourly rate $50 x 40 hrs = $2000/week

- Billable time 80%

- Superannuation 12% = $6/hour = $240/week

- Office Space, air con, power $300/week

- Computer, software, phone $150/week

- Percentage of supervisor costs (one supervisor per 10 staff @ 50% billable @$75/hr) $150/week

- Other expenses – training, recruitment, payroll etc $150/week

2000 + 240 + 300 + 150 + 150 + 150 = $2990

$2990 / 32 hours (for 80%) =

$93.43 / billable hour

Almost double the hourly rate! Typically, companies just double the hourly rate paid as an estimate of these “overheads”.

If the consultant was charged out at $100 per hour, there would be almost zero profit if they were fully utilized to that 80% rate.

Add profit, and allow for times where the billable rate cannot be achieved (eg holiday season, times where there is no incoming work), and the rate quickly needs to be well above the $100 mark, more like $150-$200 per hour.

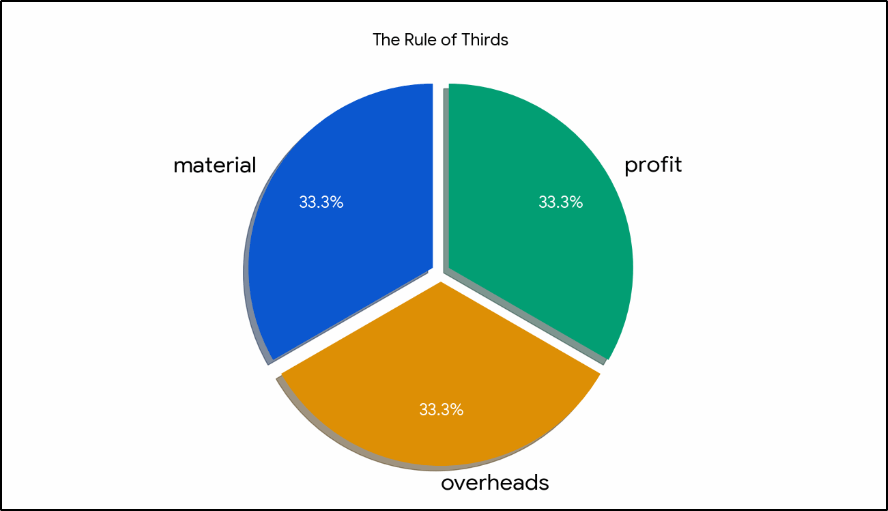

How does that compare to other businesses?

In the hospitality industry, a common pricing method is the ‘rule of thirds’.

This means the sale price of a product or service is made up of three components:

- raw materials

- overheads

- profit

Let’s take the example of a takeaway coffee. To make the math simple, we will set the sale price at $6.00.

- $2.00 for raw materials (coffee beans, milk, sugar, disposable cup)

- $2.00 for overheads (shop rent, coffee machine, salaries, business licences, insurances, etc)

- $2.00 for profit.

So if the coffee shop sells 500 cups of coffee per day, the takings are $3,000 but the actual profit is only $1,000.

You can do that same calculation for any other hospitality service – a $12.00 drink, a $36.00 meal. One third is profit, the rest are raw material costs and business overheads.